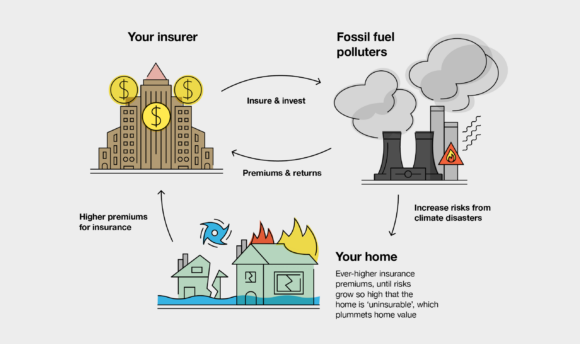

Insurance companies are supposed to protect us from catastrophic risks. Yet when it comes to the largest threat to humanity – climate change – insurers are perpetuating dependence on fossil fuels by insuring new coal, oil and gas projects. Insure Our Future U.S. is a campaign holding the U.S. insurance industry accountable for its role in the climate crisis.

Insure Our Future, Not Fossil Fuels

Insurance Company Climate Commitments

You can’t drive a car or buy a house without insurance. Likewise, without insurance, companies cannot build or operate coal plants or oil pipelines. Insure Our Future tracks insurance companies’ commitments to end support for the fossil fuels driving the climate crisis.

1

7

$582 billion

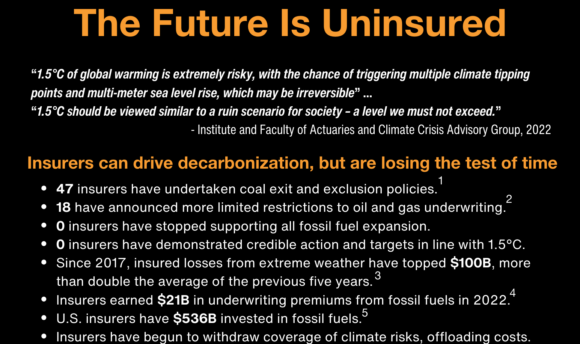

It’s time for U.S. insurers to follow the science and ditch fossil fuels

As more insurance companies around the world restrict and end coverage for coal, oil and gas, fossil fuel companies face rate increases that could make new projects unviable. But U.S. insurers continue to provide a lifeline to the fossil fuel industry.

Insurers are also major investors—they have over $35 trillion in assets. Many invest their customers’ premiums in the fossil fuels driving climate change.

U.S. insurers should immediately stop insuring new fossil fuel projects and phase out existing coal, oil and gas insurance in line with a 1.5°C pathway.

Explore our campaigns to stop insuring the unacceptable.